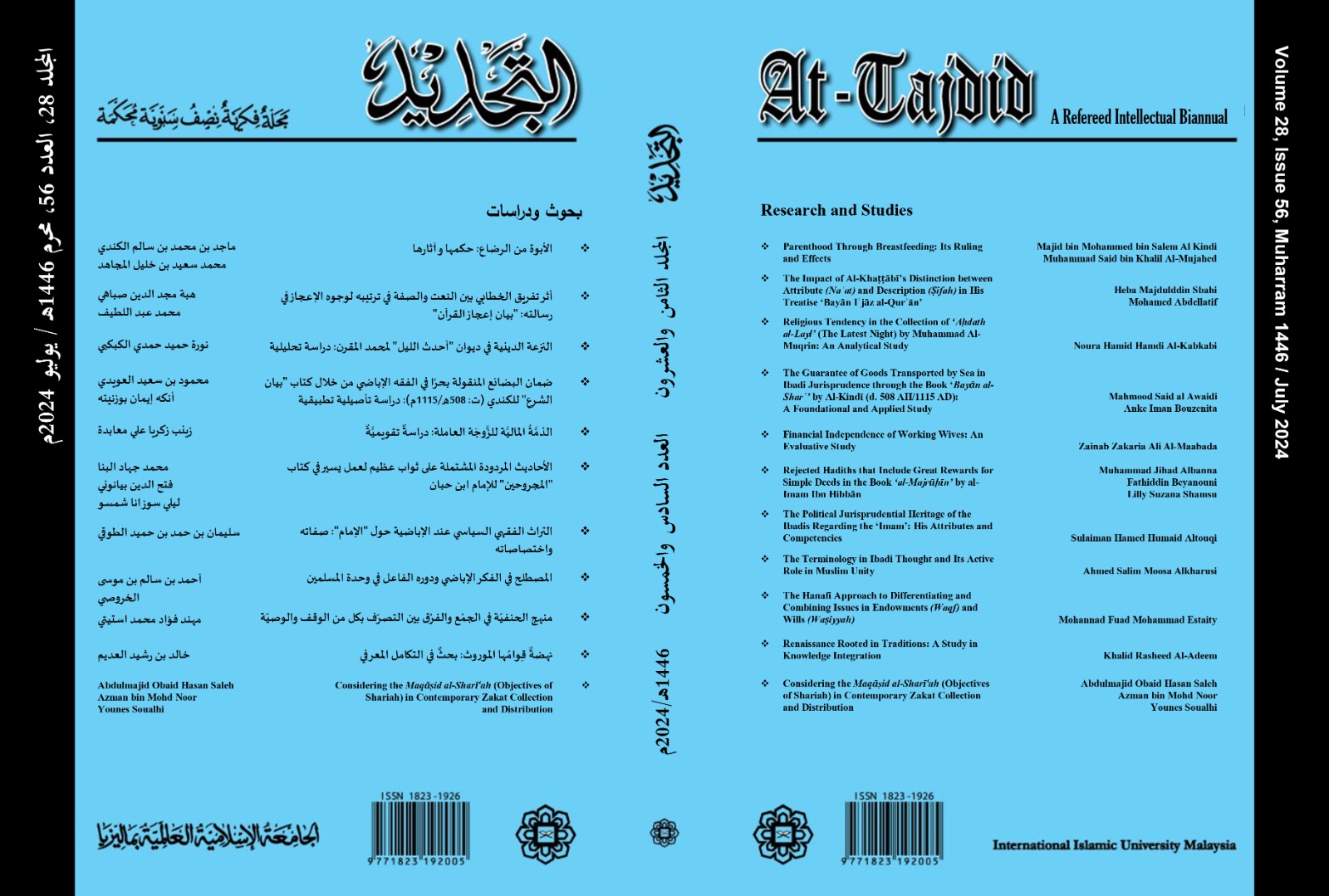

Considering the Maqasid al-Shariah (Objectives of Shariah) in Contemporary Zakat Collection and Distribution

Considering the Maqasid al-Shariah (Objectives of Shariah) in Contemporary Zakat Collection and Distribution

Abstract

Abstract

Questions arise on the efficiency of zakat collection and distribution and its socio-economic effects from Maqasid al-Shariah perspective. This paper attempts to expound some anticipated objectives (maqasid) and wisdoms of zakat obligation which is one of the pillars of Islam. In relation to this, there are some current issues pertaining to the collection of zakat such as the legitimacy of zakat on paper money, commercial crops and fruits, different kinds of incomes and mechanisms to improve zakat collection and distributions. This paper proposes some suggestions to address those issues with the anticipation that the contemporary zakat system will stay align with the broader objectives of Islamic law, including justice, equity, and social welfare.

Keywords: Collection of zakat, Maqasid al-Shariah Zakat distribution.

Downloads

References

Asmah A. Jamil, Muslimah M. Jamil, Huzaimah Ismail, Nafisiah A. Rahman. (2013), “The Management of Zakat Institutions In Malaysia”, The 5th International Conference on Financial Criminology (ICFC) Global Trends in Financial Crimes in the New Economies.

Bahuti, Mansur bin Yunus. (1980). Kashshaf al-Qina. Bayrut: Dār al-Fikr.

Bukhāri, Muhammad Ibn Ismā’īl.(2000). Sahih al-Bukhāri. Jeddah: Dar Tawq an-Najāh.

Choudhury, M. A., & Silvia, B. (2006). A Phenomenological Conception of Private Sector Responsibility In Socioeconomic Development, pp. 796-807.

Suprayitno, H., and Harahap, M. "Zakat Distribution Studies as Islamic Social Fund." Scopus, 2021.

Fitriyani, F., Harahap, M., and Suprayitno, H. "The Influence of Human Needs in the Perspective of Maqasid al-Syari'ah on Zakat Distribution Effectiveness." ResearchGate, 2020.

Farihah Amirah Binti Ahmad Faiz, and Norhayati Hassan. "The Optimalization of Zakat in Achieving Maqashid Sharia: Case Study of Indonesia and Malaysia." ICONZBazNAS, 2018.

Ghufayli, Abdullah bin Mansur. (2008). Nawāzil al-Zakāh. Riyadh: Dār al-Mayman.

Hattab, Muhammad bin Muhammad. (2003). Mawahib al Jalīl li Sharh Mukhtasar Khalīl. Bayrut: Dār al-Fikr.

Haron, S., Zakaria, A., and Kamaruddin, S. "Distribution of Zakat Funds in Malaysia From The Maqasid Al-Syariah Perspective." HRMARS, 2019.

Ibn Abi Shaybah, Abdullah bin Muhammad. (1989). Al-Musannaf fi al-Ahādith wa al-Athār. Bayrut: Muassasah Kutub Thaqāfiyah.

Ibn al-Hummam, Muhammad bin Abd al-Wāhid. (2003). Sharh Fath al-Qadīr. Al-Riyadh: Dār al-‘Alam al-Kutub.

Ibn Bāz, ‘Abd al-‘Aziz bin Abdullah. (2000). Fatawa al-Lajnah al-Dā’imah li al-buhūth al-‘Ilmīyyah wa al-Ifta’. Qaherah: Dār Ibn al-Haythum

Ibn Qudāmah, Mawqifuddin Abdullah bin Ahmad. (2004). Al-Mughni. Al-Urdun: Bayt al-Afkar al-Dawliyah.

Kashmiri, Muhammad Anwar Shah bin Mu’zam Shah. (2007). Al-‘Urf al-Shadhiyy Sharh Sunan al-Tirmidhi. Bayrut: Dar al-Kutub al-'Ilmiyah.

Mat Isa, Muhammad Pisol. (2013). “Zakat Pendapatan dan Pendapatan Profesional: Suatu Kajian terhadap Isu-Isu dalam Pelaksanaan di Institusi Zakat di Malaysia.” Kajian awal FRGS UTP.

Maqasid al-Shari'ah of Zakat Towards Sustainable Economy AOH Saleh, MAS Qatawneh, GSA Ali Islamic Sustainable Finance, 149-159

Rahman, A. A., and Ahmad, M. N. "The Roles of Zakat Towards Maqasid Al-Shariah and Sustainable Development Goals (SDGs)." IJAZBazNAS, 2019.

Mawardi, ‘Ala al-din Abu al-Hasan Ali bin Sulayman Al-Mardawi. (1997). Al-Insaf . Bayrut: Dār al-Ihya’ al-Turāth al-‘Arabi.

Mubarakfuri, Muhammad bin Abd al-Rahman. (1989). Tuhfah al-Ahwazi fi Sharh Sunan al-Tarmidh. Madinah al-Munawwarah, al-Maktabah al-Salafiyyah.

Nawāwi, Muhayyuddin Abi Zakaria. (1996). Al-Majmū’ Sharh al-Muhazzab. Bayrut: Dār al-Fikr.

Nawāwi, Muhayiddin Abi Zakaria. (2003). Raudhah al-Talibīn. Bayrut: Dār Ibn Hazm.

Islamic Sustainable Finance Towards SDGs AOH Saleh, DM Muayyad - Islamic Sustainable Finance, 2024

Nawāwi, Muhayiddin Abi Zakaria. (2004). Sahih Muslim bi Sharh al-Nawāwi, Kaherah: Dār al-Fajr li al-Turath.

Norazlina Abdul Wahab, A. Rahim A. Rahman (2013), “Determinants of Efficiency of Zakat Institutions in Malaysia: A Non-parametric Approach”, Asian Journal of Business and Accounting, vol. 2.

Qaradawi, Yusuf. (1985),.Fiqh al-Zakat. Bayrut: Mu’assasah al-Risalah.

Sarkhasi, Muhammad bin Ahmad. (2013). Al-Mabsūt. Bayrut: Dar al-Nawadir.