History of the Afghan Central Bank, Its Sharīʿah Supervision System and Its Effect on Unifying the Sharīʿah Reference

تاريخ البنك المركزي الأفغاني ونظام الرقابة الشرعية فيه وأثره في توحيد المرجعية الشرعية

DOI:

https://doi.org/10.31436/ijfus.v8i2.348Keywords:

System, Shari`ah supervision, Central Bank, Afghan, unification of Shari`ah referenceAbstract

This article aims to explore the topic of Sharīʿah supervision in the Afghan Central Bank and its impact on unifying Sharīʿah reference. This is achieved through investigating the historical roots of banking activities, the establishment of the Afghan Central Bank, its Shari`ah supervision system, and its influence on unifying Sharīʿah reference in Islamic banks. The focus of this article will be on elucidating the establishment of the Afghan Central Bank and the opening of the field of financial transactions within its framework through rules and regulations. The current study also emphasizes the clarification of the supervisory role of the Central Bank in achieving the unification of Sharīʿah reference in Islamic banks. Researchers adopt a textual study approach, encompassing both inductive and analytical-critical methods to study scholars’ opinions on the subject and discuss them. Additionally, the researchers rely on field study methodology, conducting personal interviews with experts and specialists in the field. The current study reveals that the establishment of the Afghan Central Bank dates back to 1939 within a detailed historical context of banks in Afghanistan. Researchers also find that the Afghan Central Bank has a specific supervisory system for Islamic banks, playing a significant role in unifying Sharīʿah reference in these banks. However, it appears that there is no specific framework to regulate this aspect, in addition to the absence of truly independent Islamic government banks. Instead, there is a private Islamic bank and Islamic windows providing Islamic banking services under the supervision of the Afghan Central Bank. Nevertheless, the study notes several observations, including the absence of a specific and independent law for Islamic financial services in Afghanistan that regulates the activities of Islamic banks.

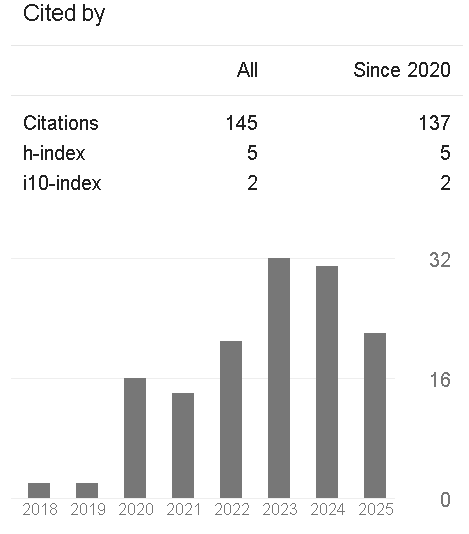

Downloads

Metrics

References

Afghanistan International Bank (AIB). (2023, January 26). https://www.aib.af

Al-Dakash, M. ʿAbd al-Munʿim. (2018). Al-Hayʾāt al-Sharʿiyyah al-ʿUlyā wa-Atharuhā ʿalā al-Maṣārif al-Islāmiyyah: Dirāsah ʿalā Baʿḍ al-Namādhij fī al-Duwal al-Islāmiyyah. (Doctoral dissertation). International Islamic University Malaysia.

ʿĀrif, ʿAbd al-Qayyūm. (2014). Taqyīm al-Niẓām al-Maṣrafī fī Afghānistān. Maktabat al-Hudā.

Azizi Bank. (2023, January 25). www.azizibank.com

Bakhtar Bank. (2023, January 26). http://dab.gov.af/fa/page/financial-supervision/licensed-financial-institutions/bakhtar-bank

Da Afghanistan Bank (DAB). (2022, October 3). DAB history. https://dab.gov.af/dab-history-

Da Afghanistan Bank. (2021). Lāʾiḥah-yi Waẓāʾif-i Board-i Niẓārat-i Sharʿī. Al-Bank al-Markazī Afghānistān.

Dawābah, A. M. (2007). Dirāsāt fī al-Tamwīl al-Islāmī (1st ed.). Dār al-Salām li-al-Ṭibāʿah wa-al-Nashr wa-al-Tawzīʿ wa-al-Tarjamah.

Ghazanfar Bank. (2023, January 25). Our profile. http://ghazanfarbank.com/dari/our-profile.html

Ḥamīdī, M. (2021). Mahām Hayʾāt al-Fatwā wa-al-Raqābah al-Sharʿiyyah fī al-Maṣārif al-Islāmiyyah: Afghānistān Anmūdhajan. (Doctoral dissertation). Sabahattin Zaim University, Turkey.

Ḥanafī, ʿAbd al-Ghaffār. (1997). Idārat al-Bunūk. Al-Dār al-Jāmiʿiyyah.

Hīdī, M. I. (2002). Idārat al-Aswāq wa-al-Munshaʾāt al-Māliyyah. Munshaʾat al-Maʿārif.

Ibrāhīmī, M. Y. (2020). Ḥawālat al-Bunūk: Aḥkāmuhā wa-Taṭbīqātuhā al-Muʿāṣirah fī al-Fiqh al-Islāmī wa-al-Qawānīn al-Afghāniyyah. (Doctoral dissertation). Nangarhar University, Afghanistan.

Jawharī, ʿAbd al-Raʾūf. (2015). Khadamāt-i Bānkdārī dar Afghānistān. Nāshirān-i Pazhūhishgāh-i Afghānistān.

New Kabul Bank. (2023, January 24). Islamic banking overview. http://newkabulbank.com/english/Islamic-banking-overview.php

Saʿīd ʿAlī, ʿAbd al-Munʿim wa-Ākharūn. (2004). Al-Nuqūd wa-al-Maṣārif wa-al-Aswāq al-Māliyyah. Dār al-Ḥāmid li-al-Nashr wa-al-Tawzīʿ.

Shaʿbān, M. A. (1996). Imkānāt Istifādah az Naẓariyyāt wa-Siyāsāt-i Pūl wa-Bānkdārī dar Afghānistān. Peshawar, Pakistan.

Shawādir, Ḥ. (2014). ʿAlāqat al-Bunūk al-Islāmiyyah bi-al-Bunūk al-Markaziyyah fī Ẓill Nuẓum al-Raqābah al-Naqdiyyah al-Taqlīdiyyah. ʿImād al-Dīn li-al-Nashr wa-al-Tawzīʿ.

Usāmah, M. al-Fūlī wa-Ākharūn. (2005). Iqtiṣādiyyāt al-Nuqūd wa-al-Tamwīl. Al-Dār al-Jāmiʿiyyah al-Jadīdah.

Wizārat al-ʿAdliyyah. (2012). Qānūn Da Afghānistān Bānk. (1st ed.). Al-Jarīdah al-Rasmiyyah.

Zarʿī, ʿAbd al-Maʿbūd. (2019). Bānkdārī-yi Islāmī wa-Shīwahā-yi Taṭbīq-i Ān dar Afghānistān. (1st ed.). Maṭbaʿah Sunnatī Chārdihī.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 International Journal of Fiqh and Usul al-Fiqh Studies

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.

The IIUM journal follows the open access policy.

Consent to publish: The Author(s) agree to publish their articles with IIUM Press.

Declaration: The Author(s) declare that the article has not been published before in any form and that it is not concurrently submitted to another publication, and also that it does not infringe on anyone’s copyright. The Author(s) holds the IIUM Press and Editors of the journal harmless against all copyright claims.

Transfer of copyright: The Author(s) hereby agree to transfer the copyright of the article to IIUM Press, which shall have the exclusive and unlimited right to publish the article in any form, including in electronic media. However, the Author(s) will reserve the right to reproduce the article for educational and scientific purposes provided that the written consent of the Publisher is obtained. For the article with more than one author, the corresponding author confirms that he/she is authorized by his/her co-author(s) to grant this transfer of copyright.