Green Ṣukūk and Their Applicability in Nigeria: An Exploratory Maqāṣidic Study

الصكوك الخضراء وإمكانية تطبيقاتها في نيجيريا: دراسة استكشافية مقاصدية

DOI:

https://doi.org/10.31436/ijfus.v6i1.251Keywords:

Green Ṣukūk, Maqāṣid Al-Sharīʽah, NigeriaAbstract

This research aims to explore the applicability of green ṣukūk in Nigeria. Green ṣukūk is a modern financial instrument, which refers to an investment certificate issued for the protection of environment, climate, plants, water, and air from pollution. This (definition of green ṣukūk) clearly indicates its significance in the realization of Maqāṣid Al-Sharī’ah (objectives of Sharīʽah) in providing benefits (maṣlaḥah) or blocking harm (mafsadah) or both. Thus, it is one of the new jurisprudential issues worthy of conducting research on, particularly because the researchers, to the best of their knowledge, have not found any academic research on green ṣukūk in Nigeria. This may be because of lack of any experience of its issuance. All these motivated the researchers for conducting this research. Also, the researchers believe that the projects that will be accomplished by issuing these green ṣukūks will lead to solving the problems of poverty, unemployment and hunger through participation in achieving food security, providing job opportunities, and creation of all forms of agro-infrastructures, thereby, achieving sustainable development in the light of Maqāṣid Al-Sharīʽah. The paper adopts exploratory and inductive methods. The first method explores the situation of Nigerian financial and economic system and its dire need for green sukuk, and the potential of its application, while the inductive method ensures linking the research with the framework of the Objectives of Sharīʽah and their principles. The findings of this research show that there are huge potentials and relevance of green ṣukūk in the Nigerian context which realizes the Maqāṣid Al-Sharīʽah in the Nigerian Islamic financial system. Likewise, it prevents environmental pollution and alleviates poverty, hunger, and unemployment. Therefore, the paper recommends the issuance of green ṣukūk in Nigeria by establishing its operational framework, and setting legal, regulatory and policy guidelines while taking into consideration the likely challenges for that.

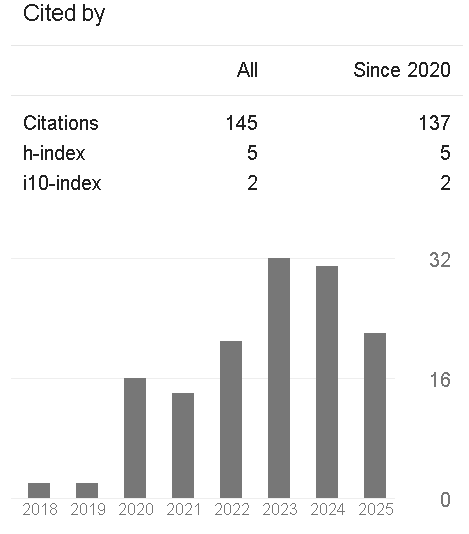

Downloads

Metrics

References

AAOIFI Shari’ah Standards. 2017. Accounting and Auditing Organization for Islamic Financial Institutions. Manamah, Bahrain.

ʿAbd al-ʿAzīz, ʾAkhtar Zaytī. 2009. Al-Ṣukūk al-ʾIslāmiyyah (al-Tawrīq) Wa Taṭbīqātuhā al-Muʿāṣirah Wa Tadāwuluhā. Sharjah: Majmaʿ al-Fiqh al-ʾIslāmī al-Dawlī.

Abdullah, Shafi Ibrahim. 2013. Sukuk as an Alternative Source of Funds for Nigerian Government. In book: Essentials of Islamic Banking and Finance in Nigeria. Benchmark Publishers Ltd.

Adam, Nathif, J. and Abdulkader Thomas. 2004. Islamic Bonds: Your Guide to Issuing, Structuring and Investing in Sukuk. London: Euromoney Books.

ʾAḥmad, Sālim Malḥam. n.d. Mafhūm Wa Mashrūʿiyyat al-Ṣukūk al-ʾIslāmiyyah. Retrieved from: http://www.drahmadmelhem.com/p/1.html

Al-Bukhārī, Muḥammad bin ʾIsmāʿīl. 1989. Al-ʾAdab al-Mufrad. Beirut: Dār al-Bashāʾir al-ʾIslāmiyyah.

Al-Dasūqī, ʾAḥmad. 2019. Kullu Mā Turīdu Maʿrifatahu ʿAn al-Ṣukūk Wa ʾĀliyāti Taṭbīqātihā, 50 Suʾālan Wa Jawāban. Retrieved from: https://almalnews.com/مفاهيم-الصكوك-آليات-تطبيقها/

Al-Khādimī, Nūr al-Din bin Mukhtār, 1998. ʿAl-Ijtihad al-Maqāṣidī: Hujjīyyatuh, Dhawābituh, Majālātuh. Qatar: Wizārat al-Awqāf wa Shu’ūn al-Islāimīyyah

Al-Khādimī, Nūr al-Din bin Mukhtār, 2001. ʿIlm al-Maqāṣid al-Sharʿiyyah. Riyadh: Maktabah al-ʿAbīkān.

Almaany. 2021. Arabic Multilingual Dictionary, Sukuk. تعريف و شرح و معنى الصكوك بالعربي في معاجم اللغة العربية معجم المعاني الجامع، المعجم الوسيط ،اللغة العربية المعاصر ،الرائد ،لسان العرب ،القاموس المحيط - معجم عربي عربي صفحة 1 (almaany.com)

Alpen Capital. 2021. Islamic Finance and Wealth Management Report. Alpen Capital, Alpen Asset Advisors and Dubai The Capital of Islamic Economy.

Al-Sā’atī, AbdulRahīm AbdulHamīd. 2010. Al-Wadhā’if al-Iqtiṣādīyyah Li-Al- Ṣukūk Nadharatan Maqāṣidiyyah. Nadwat Al- Ṣukūk al-ʾIslāmiyyah ‘Ardh Wa Taqdīm, Jeddah.

Al-Shāṭibī, ʾAbū ʾIsḥāq ʾIbrāhīm bin Mūsā. 1997. Al-Muwāfaqāt Fī ʾUṣūl al-Sharīʿh. Saudi Arabia: Dār ʾIbn ʿAffān.

Al-ʿUmrānī, ʿAbdullāh and al-Suḥaybānī, Muḥammad. 2013. Al-Taṣkīk Fī al-ʾAswāq al-Māliyyah al-ʾIslāmiyyah, Ḥālah Ṣukūk al-ʾIjārah. Kursīy Sabic Li Dirāsāt al-Aswāq al- ʾIslāmiyyah SSRN Electronic Journal. https://dx.doi.org/10.2139/ssrn.2276122

Al-Yūbīy, Muhammad bin Sa’ad bin Ahmad bin Mas’ūd. 1998. Maqāṣid Al-Sharī’ah Al-Islāmīyyah Wa ‘Alāqatihā bil Adillat Al-Shar’īyyah, Dār Al-Hijrah, Riyadh

Bahuet C. 2018. Indonesia’s Green Sukuk: A Leap towards Financing the Sustainable Development Goals. Retrieved from: https://www.undp.org/blog/indonesias-green-sukuk

Benthameur Saadeddine. 2014. Al-Ṣukūk al-ʾIslāmiyyah Wa Dawruhā Fī Taḥqīq al-Maqāṣid al-Sharʿiyyah. M.A Thesis. Algeria: Jāmiʿah al-Ḥāj LaKhadar Bātnah.

Bin Bayyah, Abdullahi. 2017. Maqāṣid al-Mu’āmalāt Wa Marāṣid al-Waqi’āt. Dār al-Muwadda’. Abu Dhabi, United Arab Emirate (UAE)

Būhaddah, Ghāliyah. 2020. Maqāṣid al-Sharīʿah Fī Bināʾ Niẓām al-Tashrīʿ al-ʾIslāmī. Course Lecture Notes: International Islamic University Malaysia.

Būhrāwah, Saʿīd. 2015. Al-ʾIshkāliyyāt al-Sharʿiyyah al-Mutalliqah Bi ʾIṣdārāt al-Ṣukūk. Kuala Lumpur: International Shari’ah Research Academy for Islamic Finance

Dailytrust. 2020. Embrace Gains of Green, Sukuk Bonds-NGX, The Nigerian Exchange Group Limited (NGX). Retrieved from: https://dailytrust.com/embrace-gains-of-green-sukuk-bonds-ngx

Djafri and Laldin. 2019 The Malaysian Experience in Sukuk Issuance. International Shariah Research Academy Journal (ISRA), Vol. 10(1).

Faza, Raniya. 2017. Al-Sukūk al-Khadirā Wasīlah Jadīdah Li Tatwīr al-Iqtiṣād Wa al-Hifāz Alā al-Bī’ah Tu’arrif Alayhā. Retrieved from: https://www.youm7.com/story/2017/8/19/الصكوك-الخضراء-وسيلة-جديدة-لتطوير-الاقتصاد-والحفاظ-على-البيئة-تعرف/3374679

FGN, Sukuk Prospectus. 2017. Sukuk Prospectus Execution Version, FGN Sukūk Road Company 1 Plc., Federal Republic Nigeria.

Ibn Āshūr, Muhammad Tahir. 1984. Tafsīr al-Tahrīr Wa al-Tanwīr. Vol. 3., Dār Al-Tūnisīyyah, Tūnis

IMF. 2021. IMF Executive Board Concludes 2021 Article IV Consultation with Maldives. Retrieved from: https://www.imf.org/en/News/Articles/2021/10/07/pr21287-maldives-imf-executive-board-concludes-2021-article-iv-consultation

Iqbal, Zamir and Mirakhor, Abbas. 2007. An Introduction to Islamic Finance: Theory and Practice, Singapore: John Wiley & Sons.

Jughaym, Nuʿmān. 2004. Ṭuruq al-Kashf ʿAn Maqāṣid al-Sharīʿah. Amman: Dār al-Nafāʾis.

Kamāl, Rāmī Muḥammad. 2019. Al-Ṣukūk Wa Taṭbīqatuhā al-Muʿāṣirah Badīlan ʿAn al-Sanadāt al-Taqlīdiyyah. Mecca: Dar al-Ṭaybah al-Khaḍraʾ.

Lawal N. Mohammed. 2018. Potentials of Istisna-Ijarah Sukuk on Electricity Financing in Kano State, Nigeria: Lessons from Osun State. M.Sc. Thesis. IIUM Institute of Islamic Banking & Finance (IIiBF).

Lotus Capital Halal Investment Limited. 2020. How Nigeria’s Appetite for Green Bonds and Sukuk Could See Eye to Eye. Retrieved from: https://www.lotuscapitallimited.com/how-nigerias-appetite-for-green-bonds-and-sukuk-could-see-eye-to-eye/

Maʿāyīr Al-Sharʿiyyah, 2017. Hayʾah al-Muḥāsabah Wa Al-Murājaʿah Li al-Muʾassasāt al-Māliyyah al-ʾIslāmiyyah (AAOIFI), Bahrain.

Maḥmūd, Muḥammad. 2017. Al-Ṣukūk al-Khaḍiraʾ, Taḥaddiyāt Kabīrah Wa ʾĀfāq ʿAdīdah. Retrieved from: https://islamonline.net/الصكوك-الخضراء-تحديات-كبيرة-وآفاق/

Maḥmūd, Muḥammad. 2021. Dawr al-Ṣukūk Fī Tamwīl al-Mashārīʿ al-Tanmawiyyah Fī ʾIfrīqiyyā. Retrieved from: https://islamonline.net/دور-الصكوك-في-تمويل-المشاريع-التنموية/

Muslim, ʾAbū al-Ḥasan Muslim bin al-Ḥajjāj. n.d. Ṣaḥīḥ Muslim. Beirut: Dār ʾIḥyāʾ al-Turāth al-ʿArabī.

Nigerian Capital Market Master Plan 10 Year Master Plan 2015-2025, Securities and Exchange Commission (SEC), Federal Republic of Nigeria.

Ofemum E. 2017. Exploring Bonds & Sukuk for Infrastructure Development. NIQS Workshop Abuja, Offshore Capital and Asset Investment PLC.

Oladunjoye, Majeed Oladele. 2014. Sukuk As A Tool for Infrastructural Development in Nigeria. Journal of Islamic Banking and Finance, American Research Institute for Policy Development, Vol. 2(1).

Raysūnī, ʾAḥmad. 1995. Naẓariyyah al-Maqāṣid ʿInda al-ʾImām al-Shāṭibī. International Institute of Islamic Thought (IIIT).

Refinitive. 2021. Sukuk Perceptions and Forecast Study 2021: Thriving Amidst Uncertainty. London Stock Exchange Group and support by Cresent Finance.

Sābūnī Muhammad Alī. 2012. Fiqh al-Mu’āmalāt. Vol. (1). Maktabat al-‘Asrīyyah, Beirut Lebanon.

SEC 2013. Rules and Regulations for Issuing Sukuk in Nigeria, Securities and Exchange Commission, Federal Republic of Nigeria. The Securities and Exchange Commission, Nigeria.

Securities Commission Malaysia. 2019. Sustainable and Responsible Investment Sukuk Framework.

Shalabī, Mājidah ʾAḥmad ʾIsmāʿīl. 2006. Taṭawwur ʾAdāʾ Sūq al-ʾAwrāq al-Māliyyah al-Miṣriyyah Fī Ẓill al-Taḥaddiyyāt al-Dawliyyah Wa Maʿāyīr Ḥawkamah al-Sharikāt Wa Tafʿīl Nashʾat al-Tawrīq. Jāmiʿah al-ʾImārāt: Muʾtamar ʾAswāq al-ʾAwrāq al-Māliyyah Wa al-Burṣāt.

Shubayr, Muḥammad ʿUthmān. 2014. Al-Takyīf al-Fiqhī Li al-Waqāʾiʿ al-Mustajaddah Wa Taṭbīqātuhā al-Fiqhiyyah. Damascus: Dār al-Qalam.

ʿUmar, ʾAbū ʿĀlim. 2021. Ḥadīth Sharīf ʿAn al-Zirāʿah. Retrieved from: https://sotor.com/حديث-شريف-عن-الزراعة/

Wendling, Z. A., Emerson J. W. de Sherbinin A. Esty D. C. et al. 2020. Environmental Performance Index. New Haven, CT: Yale Centre for Environ. Law & Policy.

World Bank. 2020. Pioneering the Green Sukuk: Three Years On (October), World Bank Group, Washington, DC. USA.

Yahuza, B. S. 2020. Muzara’ah Sukuk Model for the Development of Agriculture and Capital Market in Nigeria. 12th International Conference on Islamic Economics and Finance (ICIEF), Istanbul Turkey.

Downloads

Published

How to Cite

Issue

Section

License

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.

The IIUM journal follows the open access policy.

Consent to publish: The Author(s) agree to publish their articles with IIUM Press.

Declaration: The Author(s) declare that the article has not been published before in any form and that it is not concurrently submitted to another publication, and also that it does not infringe on anyone’s copyright. The Author(s) holds the IIUM Press and Editors of the journal harmless against all copyright claims.

Transfer of copyright: The Author(s) hereby agree to transfer the copyright of the article to IIUM Press, which shall have the exclusive and unlimited right to publish the article in any form, including in electronic media. However, the Author(s) will reserve the right to reproduce the article for educational and scientific purposes provided that the written consent of the Publisher is obtained. For the article with more than one author, the corresponding author confirms that he/she is authorized by his/her co-author(s) to grant this transfer of copyright.