Issues and Concerns of Zakāh Management in Bangladesh: A Way Forward from an E-Zakāh Perspective

قضايا وتحديات إدارة الزكاة في بنغلاديش: نحو آفاق جديدة في تطبيقات الزكاة الإلكترونية

DOI:

https://doi.org/10.31436/ijfus.v7i2.306Keywords:

Challenges, E-Zakāh, Bangladesh, Zakāh, ManagementAbstract

Zakāh is considered as one of the fundamental pillars of Islam and an important Islamic financial concept. Zakāh plays a significant and critical role in addressing poverty and inequality in Muslim communities. However, implementation of effective, and successful Zakāh management poses significant challenges in many countries, including Bangladesh. This study aims to identify the challenges associated with Zakāh management in Bangladesh and explore the implementation of the E-Zakāh application in terms of its proper collection and distribution. Through a deeper understanding of the literature review and analysis of available accessible data, the study identifies several significant deficiencies and major shortcomings in the Zakāh administration including lack of transparency and accountability, inadequate infrastructure, limited awareness and education, ineffective monitoring and evaluation systems, and inefficient collection and distribution mechanisms. This study uses an analytical and descriptive method to examine the challenges in Zakāh administration in Bangladesh. By adopting a qualitative research approach, this study aims to gain an in-depth understanding of these challenges and propose solutions. Furthermore, the article proposes a broad strategy for the effective implementation of E-Zakāh that includes the establishment of technological infrastructure, regulatory reform, capacity building, and public awareness campaigns. Finally, the present study contributes to the existing literature by clarifying the obstacles and opportunities of the Zakāh administration in Bangladesh and proposes a viable solution through the adoption of E-Zakāh. By utilising the endless possibilities of technological advances, the proposed strategy could improve the impact of Zakāh, stimulate socio-economic growth, and empower marginalised communities in Bangladesh.

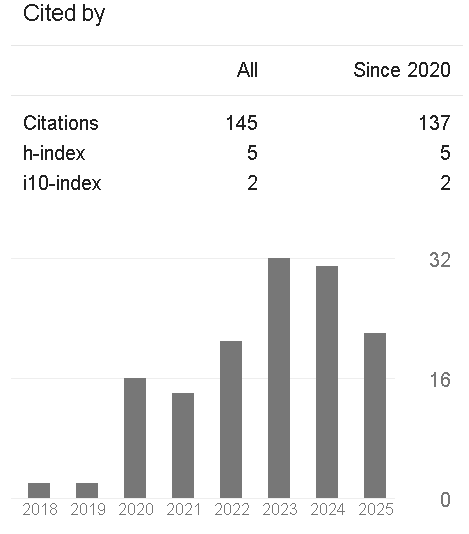

Downloads

Metrics

References

Ataina, H., & Tohirin, A. 2010. Management Of Zakah: Centralised Vs Decentralised Approach. Seventh International Conference – The Tawhidi Epistemology: Zakat and Waqf Economy, Bangi.

Bangladesh Economic Review: Poverty Alleviation (Chapter Thirteen: Poverty Alleviation). 2022. Bangladesh Ministry of Finance. https://mof.portal.gov.bd

Banglanews24. 2018. 10 killed in Satkaniya while collecting Zakat.https://www.banglanews24.com/national/news/bd/653272.details

Ben Jedidia, K., & Guerbouj, K. 2021. Effects of zakat on the economic growth in selected Islamic countries: Empirical evidence. International Journal of Development Issues, 20(1), 126–142. https://doi.org/10.1108/IJDI-05-2020-0100

Hashmi, T. 2015. “Zakat-Deaths” in Bangladesh: An old story of piety and power. The Daily Star. https://www.thedailystar.net/op-ed/%E2%80%9Czakat-deaths%E2%80%9D-bangladesh-old-story-piety-and-power-113527

Hassan, M. K., Khan, M. Z. H., & Islam, M. K. 2022. The potential of Zakat to transform the Bangladesh economy. The Business Standard. https://www.tbsnews.net/thoughts/potential-zakat-transform-bangladesh-economy-488042

Islam, M. S. 2016. Towards An Establishment Of Zakat Institution In Bangladesh Based On Malaysian Experience: A Juristic And Analytical Study. 12.

Islam, M. S., & Salma, U. 2020. The Management Of Zakat By Center For Zakat Management (Czm): A Malaysian Experience. International Journal Of Zakat And Islamic Philanthropy, 2(1), 184–191.

Islam, Md. K., Mitu, S. T., Munshi, R., & Khanam, R. 2023. Perceptions about the common malpractice of Zakat paying in Bangladesh during Covid-19 pandemic: Evidence from the supply side. Journal of Islamic Accounting and Business Research, 14(3), 361–378. https://doi.org/10.1108/JIABR-09-2021-0253

Jahangir, R., & Bulut, M. 2022. Estimation Of Zakat Proceeds In Bangladesh: A Two-Approach Attempt. Journal of Islamic Monetary Economics and Finance, 8(1), 133–148. https://doi.org/10.21098/jimf.v8i1.1455

Johoora, F. 2021, May. The Zakat as a means of wealth redistribution: What role for the state? ICTD. https://www.ictd.ac/blog/zakat-wealth-redistribution-role-state/

Nabi, G., Islam, D. A., Sarder, W., & Rahman, M. 2021. Estimation of Zakat and Its Use as An Effective Tool for Socio-economic Development in Bangladesh. 31(1 & 2), 33–56.

Nagad Islamic introduces Zakat calculator. 2022, April 10. New Age. https://www.newagebd.net/article/167769/nagad-islamic-introduces-zakat-calculator

Ninglasari, S. Y., & Muhammad, M. 2021. Zakat Digitalization: Effectiveness of Zakat. Journal of Islamic Economic Laws, 4(1), 26–44.

Obaidullah, M. 2015. Zakah Management in Rural Areas of Bangladesh: The Maqasid Al-Shari’Ah (Objectives of Islamic Law) Perspective. Middle-East Journal of Scientific Research, 23(1), 45–54. https://doi.org/10.5829/idosi.mejsr.2015.23.01.22032

Pay zakat to the underprivileged through bKash. 2022, April 25. The Business Standard. https://www.tbsnews.net/economy/corporates/pay-zakat-underprivileged-through-bkash-409282

Rahman, M. H., & Obaidullah, A. K. M. 2021. Zakat Management in Bangladesh: An Analysis. Islami Ain O Bichar, 17(66), 133–162.

Rahman, S. 2021, September 11. Zakat Fund couldn’t mobilise even 1.0pc of potential charity amountThe Financial Express | First Financial Daily of Bangladesh. The Financial Express. https://beta.thefinancialexpress.com.bd

Report, S. D. 2023, January 25. New bill passed to streamline zakat management [News paper]. The Daily Star. https://www.thedailystar.net/news/bangladesh/news/new-bill-passed-streamline-zakat-management-3230361

Sun, daily. 2022, November 6. Zakat Fund Management Bill 2022 places in JS. Daily Sun. https://www.daily-sun.com/post/654495/Zakat-Fund-Management-Bill-2022-places-in-JS

The Business Post. 2023, December 3. Zakat collection rises, but management still in disarray. The Business Post. https://businesspostbd.com/back/2023-03-12/zakat-collection-rises-but-management-still-in-disarray-2023-03-12

The World Bank In Bangladesh. 2022, October 6. World Bank. https://www.worldbank.org/en/country/bangladesh/overview

Uddin, A. E. 2016. Through Islamic Banks’ Zakat House (IBZH): Investment of Zakah Funds in Microfinance to Remove Poverty in Bangladesh : A New Model. International Journal of Islamic Economics and Finance Studies, 2(1), 1–25. https://doi.org/10.12816/0036592

Uddin, N., Uddin, M. J., & Ullah, C. 2019. Role of Zakat as a Tool of Poverty Alleviation and Sustaina- ble Development: The Case of Bangladesh. BANGLADESH JOURNAL OF ISLAMIC THOUGHT, 15(24), 55–68.

Uddin Noyon, A. 2021, April 22. Zakat economy: Little use of a huge potential. The Business Standard. https://www.tbsnews.net/feature/zakat-economy-little-use-huge-potential-235756

Zakat Fund Report. 2015. islamicfoundation.portal.gov.bd. https://islamicfoundation.portal.gov.bd/sites/default/files/files/islamicfoundation.portal.gov.bd/notices/cd4ab429_b5b0_42bb_9012_756bde18a80a/pdf247.pdf

Zohrul Islam, M., & Hassan, M. K. 2022. Zakat Administration: Principles and Contemporary Practices. Bangladesh institute of Islamic Thought (BIIT).

Downloads

Published

How to Cite

Issue

Section

License

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.

The IIUM journal follows the open access policy.

Consent to publish: The Author(s) agree to publish their articles with IIUM Press.

Declaration: The Author(s) declare that the article has not been published before in any form and that it is not concurrently submitted to another publication, and also that it does not infringe on anyone’s copyright. The Author(s) holds the IIUM Press and Editors of the journal harmless against all copyright claims.

Transfer of copyright: The Author(s) hereby agree to transfer the copyright of the article to IIUM Press, which shall have the exclusive and unlimited right to publish the article in any form, including in electronic media. However, the Author(s) will reserve the right to reproduce the article for educational and scientific purposes provided that the written consent of the Publisher is obtained. For the article with more than one author, the corresponding author confirms that he/she is authorized by his/her co-author(s) to grant this transfer of copyright.