FISCAL ADVANTAGE OF WAQF AND THE RULE OF TAX EXEMPTION FOR CHARITABLE PURPOSES UNDER THE INCOME TAX ACT 1967

DOI:

https://doi.org/10.31436/iiumlj.v28i1.501Keywords:

Tax, Waqf, Tax exemptionAbstract

This study explores the principle of waqf in the context of current tax policies governing waqf properties. In Islamic law, waqf is defined as charity whereby the donor endows the property in the name of Allah SWT for the benefit of the public at large. However, for tax exemption purposes, there is no specific provision in the Income Tax Act 1967 (ITA). Waqf is under the State List in the Federal Constitution and it comes under the jurisdiction of state governments. Currently, there is a misunderstanding about tax deduction in Section 44(6) and Section 44(11C) of ITA that includes waqf as a gift and gets the same tax treatment. Nevertheless, there are strong justifications which state that waqf does not fall within the scope of Section 44(6). The study will analyse the status of waqf institutions which are eligible for tax deduction and the reason why waqf does not fall within the scope of donation under section 44(6) of the ITA. The methodology used in this study is doctrinal legal research whereby the analysis focuses on the legal principle of waqf in Islamic law and the rule of tax exemption under the ITA. As a result, the study found that there is inconsistency in implementing waqf for tax rebate purposes. The recommendation of this study is that a comprehensive waqf guideline should be introduced to ensure consistent development of waqf to enhance the public interest.

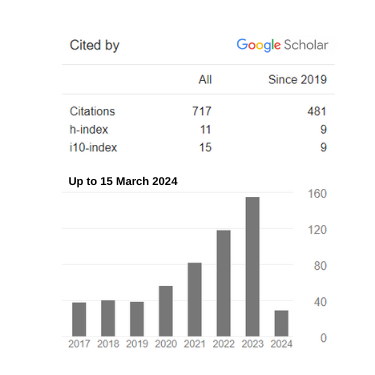

Metrics

Downloads

Published

How to Cite

Issue

Section

License

- Consent to publish: The Author(s) undertakes that the article named above is original and consents that the IIUM Press publishes it.

- Previous publication: The Author(s) guarantees that the article named above has not been published before in any form, that it is not concurrently submitted to another publication, and that it does not infringe anyone’s copyright. The Author(s) holds the IIUM Press and Editors of IIUM Law Journal harmless against all copyright claims.

- Transfer of copyright: The Author(s) hereby transfers the copyright of the article to the IIUM Press, which shall have the exclusive and unlimited right to publish the article in any form, including on electronic media. The Journal in turn grants the Author(s) the right to reproduce the article for educational and scientific purposes, provided the written consent of the Publisher is obtained.