The Scope of Taxation of Income from Illegal Activities in Selected Common Law Jurisdictions

DOI:

https://doi.org/10.31436/iiumlj.v23i3.174Keywords:

illegal activities, taxable income, allowable, expendituresAbstract

The taxation of income from illegal activities is well established in several common law jurisdictions. In the broader sense income or profits from a trade, profession or vocation irrespective of the issue of legality will be taxable. The courts have drawn a distinction between cases where normal income producing activities become illegal due to non-compliance with licensing requirements or acting in contravention to a ban in trading on one hand and profits acquired as a result of the commission of systematic crimes such as burglary on the other hand. Income from the latter source is not taxable. The objective of this paper is to argue against such a distinction, to highlight the problems inherent in computing income from an illegal source and to examine the difficulties in formulating rules governing the deductibility of expenditures incurred in earning income from illegal activities.

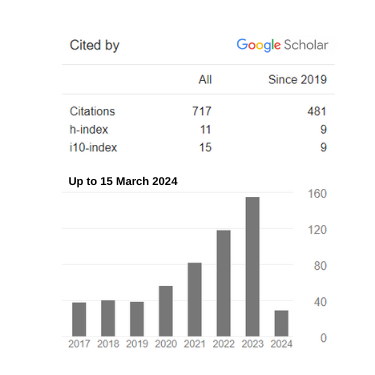

Metrics

Downloads

Published

How to Cite

Issue

Section

License

- Consent to publish: The Author(s) undertakes that the article named above is original and consents that the IIUM Press publishes it.

- Previous publication: The Author(s) guarantees that the article named above has not been published before in any form, that it is not concurrently submitted to another publication, and that it does not infringe anyone’s copyright. The Author(s) holds the IIUM Press and Editors of IIUM Law Journal harmless against all copyright claims.

- Transfer of copyright: The Author(s) hereby transfers the copyright of the article to the IIUM Press, which shall have the exclusive and unlimited right to publish the article in any form, including on electronic media. The Journal in turn grants the Author(s) the right to reproduce the article for educational and scientific purposes, provided the written consent of the Publisher is obtained.