PRINCIPLE OF AUTONOMY IN LETTER OF CREDIT: MALAYSIAN PRACTICE

DOI:

https://doi.org/10.31436/iiumlj.v19i2.9Abstract

The term letter of credit (LC) is not uncommon in international trade as it is the most frequently used method of payment by seller and buyer in their sales contract. LC serves its significant role by facilitating payment between buyer and seller from different countries, who are always prejudiced towards each other on the issue of payment, especially when the deal involves a huge amount of money. By using LC, the seller and buyer will be represented by their own bankers whose function, among others is to issue an LC for the buyer and pay on presentation of seller’s documents which strictly comply to LC requirements. It is well-known that LC is governed by the principle of autonomy or also referred to as the principle of independence1 which indicates LC, being a contract of payment is totally separate from the underlying sales contract. Banks are concerned with documents only and not with the goods. LC transaction can be governed by the Uniform Custom and Practice for Documentary Credit, known as the UCP through express incorporation which provides the rules relating to LC matters and is adopted in almost all LC transactions. This paper discusses the nature, background and significance of principle of autonomy in LC transaction. In elaborating the provisions on the principle of autonomy in the UCP 600, comparisons between relevant articles in the UCP 500 are highlighted. The discussion also focuses on relevant case law and on the application of the autonomy principle in conventional and Islamic LC. The paper concludes with the finding that Malaysian bankers fully subscribe to the principle of autonomy as outlined by the UCP 600.

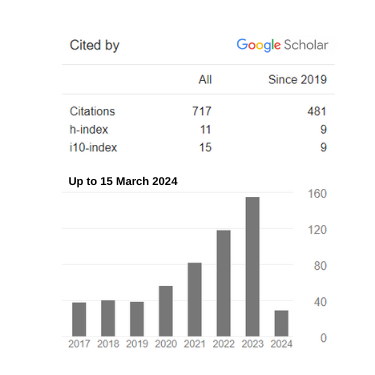

Metrics

Downloads

Published

How to Cite

Issue

Section

License

- Consent to publish: The Author(s) undertakes that the article named above is original and consents that the IIUM Press publishes it.

- Previous publication: The Author(s) guarantees that the article named above has not been published before in any form, that it is not concurrently submitted to another publication, and that it does not infringe anyone’s copyright. The Author(s) holds the IIUM Press and Editors of IIUM Law Journal harmless against all copyright claims.

- Transfer of copyright: The Author(s) hereby transfers the copyright of the article to the IIUM Press, which shall have the exclusive and unlimited right to publish the article in any form, including on electronic media. The Journal in turn grants the Author(s) the right to reproduce the article for educational and scientific purposes, provided the written consent of the Publisher is obtained.