BASEL III CAPITAL REGULATION FRAMEWORK AND ISLAMIC BANK’S RISK

DOI:

https://doi.org/10.31436/iiumlj.v30iS2.765Keywords:

Regulation, IFSB, BASEL III, Islamic Bank’s RiskAbstract

Basel III modified the requirements for approving new regulatory capital norms to improve capital quality. Because bank liquidity problems were a defining feature of the crisis, Basel III established new requirement ratios while also tightened capital requirements. The Liquidity Coverage Ratio (LCR) was developed to safeguard banks' short-term liquidity, whereas the Net Stable Funding Ratio (NSFR) is being proposed to strengthen banks' medium- and long-term liquidity shock resilience. As a necessary consequence, Islamic financial institutions (IFIs) must issue instruments that satisfy both Basel III and Shari’ah requirements. This study aims to identify the regulatory requirements for Basel III and the Islamic Financial Services Board (IFSB)'s new capital and liquidity rules, as well as the implications for Islamic banks (IB). This study employs a mixed research methodologies approach which includes document analysis of primary and secondary sources, as well as the relevant regulations published by BCBS and IFSB. This study relies on the identification of Standards for each criterion before conducting a systematic review of the 23 publications that meet the study's requirements published between 2013 and 2022. There is a scarcity of Shari’ah-compliant research on capital buffers, tier 1 capital, and common equity tier 1 capital, according to certain findings. Furthermore, the empirical literature suggests that Basel III has a significant impact on the financial risk of the IB sector in the samples collected. However, there is still a significant gap in studies investigating the influence of Basel III/IFSB capital and liquidity regulations on Islamic bank risk, or more precisely, supportive data from empirical investigations. The wealth of research will provide new insights to standard-setters (BCBS and IFSB), regulators, researchers, and academicians.

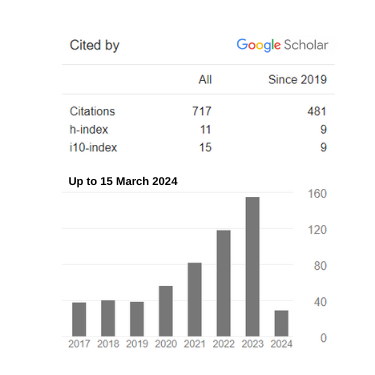

Metrics

Downloads

Published

How to Cite

Issue

Section

License

- Consent to publish: The Author(s) undertakes that the article named above is original and consents that the IIUM Press publishes it.

- Previous publication: The Author(s) guarantees that the article named above has not been published before in any form, that it is not concurrently submitted to another publication, and that it does not infringe anyone’s copyright. The Author(s) holds the IIUM Press and Editors of IIUM Law Journal harmless against all copyright claims.

- Transfer of copyright: The Author(s) hereby transfers the copyright of the article to the IIUM Press, which shall have the exclusive and unlimited right to publish the article in any form, including on electronic media. The Journal in turn grants the Author(s) the right to reproduce the article for educational and scientific purposes, provided the written consent of the Publisher is obtained.