FINTECH REGULATORY SANDBOXES IN AUSTRALIA AND MALAYSIA: A LEGAL ANALYSIS

DOI:

https://doi.org/10.31436/iiumlj.v28i1.475Keywords:

Innovation, Digitalization, Financial Regulation, Fintech, Regulatory SandboxAbstract

With the era of digitalization, regulatory sandboxes have been the trend adopted by most financial regulators around the world in regulating financial technology (fintech). Regulatory sandboxes act as a pilot programme to regulate fintech services and products with several legal exemptions given to the service providers within established parameters. In 2016, the Australian Securities and Investments Commission and the Malaysian Central Bank followed the United Kingdom’s Financial Conduct Authority (FCA) to introduce regulatory sandboxes within their legal framework. To date, previous literature has only provided a minimal analytical overview of the Malaysian and Australian regulatory sandbox. Hence, this article aims to fill that gap in literature. The methodology used for this study is both doctrinal and comparative legal analysis. The main objective of this study is to analyse the key characteristics of fintech regulatory sandboxes by comparing the Australian and Malaysian regulatory structures of these sandboxes. Due to nascent nature of Malaysian and Australian fintech regulations, this contributes to the growing knowledge in the financial regulation literature. Moreover, the findings on the operation of the regulatory sandboxes in both jurisdictions is expected to bring practical value for further research.

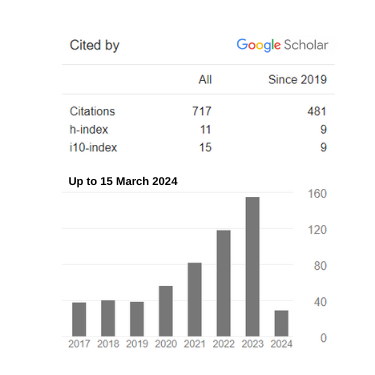

Metrics

Downloads

Published

How to Cite

Issue

Section

License

- Consent to publish: The Author(s) undertakes that the article named above is original and consents that the IIUM Press publishes it.

- Previous publication: The Author(s) guarantees that the article named above has not been published before in any form, that it is not concurrently submitted to another publication, and that it does not infringe anyone’s copyright. The Author(s) holds the IIUM Press and Editors of IIUM Law Journal harmless against all copyright claims.

- Transfer of copyright: The Author(s) hereby transfers the copyright of the article to the IIUM Press, which shall have the exclusive and unlimited right to publish the article in any form, including on electronic media. The Journal in turn grants the Author(s) the right to reproduce the article for educational and scientific purposes, provided the written consent of the Publisher is obtained.