Compatibility of Islamic Finance and Anti-Money Laundering Laws: A Myth or Reality?

DOI:

https://doi.org/10.31436/iiumlj.v26i1.344Keywords:

Money Laundering, Islamic Finance, Shari;ahAbstract

Money Laundering (ML) remains a major threat to the financial flow, as well as affecting the economic stability of any nations. It is equally capable of undermining macroeconomic performance and therefore constitutes a very significant risk to both soundness and stability of any financial institution. Foreign direct investments are therefore adversely affected. Unlike that of the capitalist economy and other conventional banking institutions, the risks which ML poses to Islamic finance attracted little or no critical study. This could give the impression that Islamic finance is not in tune with Anti-Money Laundering Laws (AML) and the regulatory regime or that it is anti-AML. The resultant effect of this is unnecessary hostility to Islamic Financial products, which appears not to be in the interest of global economy. This article, therefore, focuses on the relevance of AML principles to Islamic banking. It is revealed that while no financial institution is immune to laundering, the risk-sharing nature of Islamic finances poses less systemic risk than conventional finance. It is recommended that FATF should facilitate studies of potential ML in Islamic finance to put the issue in the right perspective.

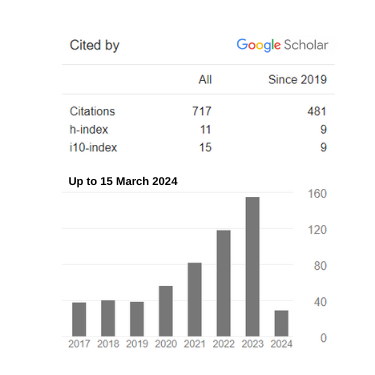

Metrics

Downloads

Published

How to Cite

Issue

Section

License

- Consent to publish: The Author(s) undertakes that the article named above is original and consents that the IIUM Press publishes it.

- Previous publication: The Author(s) guarantees that the article named above has not been published before in any form, that it is not concurrently submitted to another publication, and that it does not infringe anyone’s copyright. The Author(s) holds the IIUM Press and Editors of IIUM Law Journal harmless against all copyright claims.

- Transfer of copyright: The Author(s) hereby transfers the copyright of the article to the IIUM Press, which shall have the exclusive and unlimited right to publish the article in any form, including on electronic media. The Journal in turn grants the Author(s) the right to reproduce the article for educational and scientific purposes, provided the written consent of the Publisher is obtained.