Murābaḥah Financing in Al-Noor Islamic Window of Bank of Ceylon and Its Scope of Ability to Respond Sri Lankan Muslim Minority Needs: A Juristic Study in Light of Maqāṣid al-Sharīʿah

DOI:

https://doi.org/10.31436/ijfus.v9i2.370Keywords:

Murābaḥah, Islamic Window, Ceylon Conventional Bank, Objectives of Shariah, Muslim MinorityAbstract

This research paper explores the Murabahah product offered by Al-Noor Islamic window at the Bank of Ceylon in Sri Lanka. The phenomenon of Islamic windows within conventional banks, which is rooted in interest-based (usurious) systems, presents a new challenge to contemporary Islamic banking frameworks. However, the Islamic window faces several challenges, particularly because it operates within a traditional, usurious banking structure. These issues need to be carefully examined and addressed, with a focus on the jurisprudential concerns that arise, which require solutions that align with the context of the Sri Lankan Muslim minority. This is because the capital acquired to establish the Islamic window and the scope of autonomy of its activities and banking products, such as Murābaḥah, necessitate jurisprudential adaptation from the perspective of Maqāṣid al-Sharīʿah. From this standpoint, this study examines the application of Murābaḥah financing at Al-Noor Islamic Window of the Bank of Ceylon, considering it as one of its products in light of Maqāṣid al-Sharīʿah. This study employs an inductive approach to gather and review relevant materials, along with an analytical and comparative approach for explanation, conclusions, and discussions. The findings suggest that, while the Murābaḥah product in Al-Noor window operates with some degree of independence, it still requires further development and should be evaluated in the context of banking windows in other countries. This would help to ensure the alignment of jurisprudential solutions with local contexts. Likewise, raising the awareness of Islamic banking is essential for promoting the national economy, safeguarding and developing financial assets, and thus changing the narrow perceptions of the non-Muslim majority toward Islamic finance.

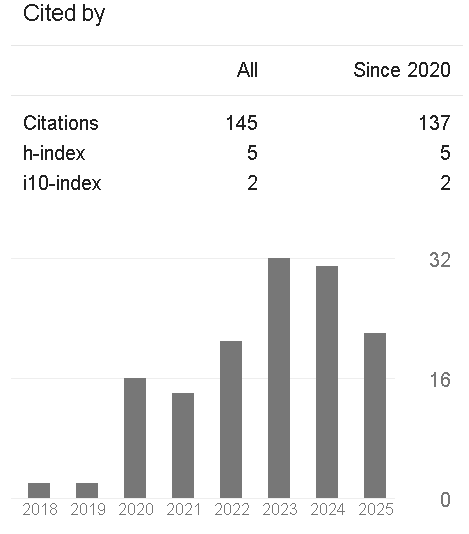

Downloads

Metrics

References

Al-Bukhārī, M. ibn I. (1420 AH). Ṣaḥīḥ al-Bukhārī (4th ed., Vol. 2). Al-Maktabah al-ʿAṣriyyah.

Al-Dakhīl, A. K. Ḥ. (n.d.). Al-Nawāfidh al-Islāmiyyah fī al-Maṣārif al-Ḥukūmiyyah al-ʿIrāqiyyah. Dirāsāt Iqtiṣādiyyah Islāmiyyah, 19(2).

Al-Ḥalwānī, B. (2001). Al-Muʿāmalāt al-Islāmiyyah fī al-Bunūk al-Gharbiyyah: Qanāʿah bi al-Manhaj al-Islāmī am Wasīlah li Jadhb Amwāl al-Muslimīn. Majallat Iqtiṣād al-Islāmī, 21, 241.

Al-Ḥaytī, ʿA. al-R. (2002). Al-Maṣārif al-Islāmiyyah bayn al-Naẓariyyah wa al-Taṭbīq. Dār Usāmah li al-Nashr wa al-Tawzīʿ.

Al-Kāsānī, ʿA. al-D. A. B. (1418 AH). Badāʾiʿ al-Ṣanāʾiʿ fī Tartīb al-Sharāʾiʿ (1st ed., Vol. 8). Dār al-Kutub al-ʿIlmiyyah.

Al-Marāṭān, S. ibn S. (1419 AH). Al-Furūʿ al-Islāmiyyah fī al-Maṣārif al-Taqlīdiyyah: Tajribat al-Bank al-Ahlī al-Tijārī. Majallat Dirāsāt Islāmiyyah Iqtiṣādiyyah, 10.

Al-Marāṭān, S. ibn S. (n.d.). Taqwīm al-Muʾassasāt al-Taṭbīqiyyah li al-Iqtiṣād al-Islāmī: Al-Nawāfidh al-Islāmiyyah li al-Maṣārif al-Taqlīdiyyah. Paper presented at the Third International Conference on Islamic Economics, Umm al-Qurā University. Retrieved from http://www.iefpedia.com/arab/?p=1746

Al-Māwardī, ʿA. ibn M. (1994). Al-Ḥāwī al-Kabīr fī Fiqh Madhhab al-Imām al-Shāfiʿī (ʿA. Muʿawwaḍ & ʿĀ. ʿAbd al-Mawjūd, Eds.; 1st ed., Vol. 8). Dār al-Kutub al-ʿIlmiyyah.

Al-Nāṣir, L. (2010). Al-Nawāfidh al-Islāmiyyah am Al-Maṣārif al-Islāmiyyah. Al-Sharq al-Awsaṭ, 11557. Retrieved from https://archive.aawsat.com/details.asp?section=58&article=578848&issueno=11557#.XwRmaigzY2w

Al-Nawawī, Y. ibn S. (1997). Al-Majmūʿah Sharḥ al-Muhadhdhab (Vol. 9). Dār al-Fikr.

Al-Rāzī, A. ibn F. ibn Z. al-Q. (1971). Muʿjam Maqāyīs al-Lughah. Dār al-Kutub al-ʿIlmiyyah.

Al-Rāzī, M. ibn A. B. ibn ʿA. al-Q. (1989). Mukhtaṣar al-Ṣiḥāḥ. Maktabat Lubnān.

Al-Sarakhsī, M. ibn A. (2000). Al-Mabsūṭ (K. al-Mays, Ed.; Vol. 1). Dār al-Fikr.

Al-Sharīf, F. (n.d.). Al-Furūʿ al-Islāmiyyah al-Tābiʿah li al-Maṣārif al-Ribawiyyah: Dirāsah fī Ḍawʾ al-Iqtiṣād al-Islāmī. Paper presented at the Third International Conference on Islamic Economics, Umm al-Qurā University. Retrieved from http://www.iefpedia.com/arab/?p=450

Al-Suyūṭī, J. al-D. ʿA. al-R. (1959). Al-Ashbāh wa al-Naẓāʾir fī Qawāʿid wa Furūʿ Fiqh al-Shāfiʿiyyah. Shirkat Maktabah wa Maṭbaʿat Muṣṭafā al-Bābī al-Ḥalabī wa Awlāduhū.

Al-Tirmidhī, M. ibn ʿĪ. ibn S. (1998). Sunan al-Tirmidhī (B. ʿAwwād, Ed.). Dār al-Gharb al-Islāmī.

Al-Zabīdī, M. ibn M. ibn ʿA. al-R. al-Ḥ. (n.d.). Tāj al-ʿUrūs min Jawāhir al-Qāmūs (Vol. 9, pp. 486-487). Dār al-Hidāyah.

Al-Zaylaʿī, ʿU. ibn ʿA. (1313 AH). Tabyīn al-Ḥaqāʾiq Sharḥ Kanz al-Daqāʾiq (Vol. 4). Al-Maṭbaʿah al-Kubrā al-Amīriyyah.

Fatāwā wa Tawṣiyyāt Nadwat al-Barakah al-ʿIshrīn li al-Iqtiṣād al-Islāmī. (2001). Ḥawliyyat al-Barakah (3rd ed.). Majmūʿat Dallah al-Barakah.

General Authority for Islamic Affairs and Endowments. (2008). Fatwa No. 1304: Ruling on dealing with Islamic windows in usury-based banks. United Arab Emirates. Retrieved August 21, 2008, from http://www.awqaf.ae/fatwa.aspx?SectionID=9&RefID=1304

Ḥammūd, S. Ḥ. A. (1982). Taṭwīr al-Aʿmāl al-Maṣrafiyyah bi mā yattafiq wa al-Sharīʿah al-Islāmiyyah [Doctoral dissertation] (2nd ed.). Maṭbaʿat al-Sharq wa Maktabatuhā.

Ibn Manẓūr, M. (n.d.). Lisān al-ʿArab (1st ed., Vol. 3). Dār Ṣādir.

Ibn Nujaym, Z. al-D. ibn I. ibn M. (1968). Al-Ashbāh wa al-Naẓāʾir ʿalā Madhhab Abī Ḥanīfah al-Nuʿmān (ʿA. al-ʿA. al-Wakīl, Ed.). Muʾassasat al-Ḥalabī wa Shurakāʾuhu li al-Nashr wa al-Tawzīʿ.

Ibn Taymiyyah, T. al-D. A. ibn ʿA. al-Ḥ. (2005). [Work title not provided] (3rd ed., Vol. 5). Dār al-Wafāʾ li al-Ṭibāʿah wa al-Nashr wa al-Tawzīʿ.

Islamic Banking and Finance Committee, National Commercial Bank of Saudi Arabia. (2006). Ruling on dealing with the management and branches of Islamic banking services at the National Commercial Bank. Retrieved January 27, 2006, from http://www.alrassxp.com/forum/t35174.htm/

Kharīs, N. S. (2014). Al-Nawāfidh al-Islāmiyyah bi al-Bunūk al-Ribawiyyah min Manẓūr Islāmī. Majallat al-Zarqāʾ li al-Buḥūth wa al-Dirāsāt al-Islāmiyyah, 14(2).

Majmaʿ al-Lughah al-ʿArabiyyah. (n.d.). Al-Muʿjam al-Wasīṭ (4th ed., Vol. 1). Maktabat al-Shurūq al-Dawliyyah.

Muṣṭafā, M. I. M. (2006). Taqyīm Ẓāhirat Taḥwīl al-Bunūk al-Taqlīdiyyah li al-Maṣrafiyyah al-Islāmiyyah [Master's thesis, American Open University]. Maktabat al-Qāhirah.

Nāṣir, A.-G. (1422 AH). Al-Ḍawābiṭ al-Sharʿiyyah. Majallat al-Iqtiṣād al-Islāmī, 245.

Qatar Shares Network Forums. (n.d.). Retrieved from http://www.qatarshares.com/vb/showthread.php?6109-%C7%E1%DD%D1%E6%DA-%C7%E1%C5%D3%E1%C7%E3%ED%C9-%DD%ED-%C7%E1%C8%E4%E6%DF-%C7%E1%CA%CC%C7%D1%ED%C9-%82%82-%CD%C7%CC%C9-%C3%E3-%CA%CD%C7%ED%E1%BF

Shaḥātah, Ḥ. Ḥ. (2001). Al-Ḍawābiṭ al-Sharʿiyyah li Furūʿ al-Muʿāmalāt al-Islāmiyyah bi al-Bunūk al-Taqlīdiyyah. Majallat Iqtiṣād al-Islāmī, 240.

Wajdī, M. F. (n.d.). Dāʾirat Maʿārif al-Qarn al-ʿIshrīn (Vol. 10). Dār al-Fikr.

Zaʿtarī, ʿA. al-D. M. (200). Al-Khadamāt al-Maṣrafiyyah wa Mawqif al-Sharīʿah al-Islāmiyyah. Dār al-Kalim al-Ṭayyib.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 International Journal of Fiqh and Usul al-Fiqh Studies

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.

The IIUM journal follows the open access policy.

Consent to publish: The Author(s) agree to publish their articles with IIUM Press.

Declaration: The Author(s) declare that the article has not been published before in any form and that it is not concurrently submitted to another publication, and also that it does not infringe on anyone’s copyright. The Author(s) holds the IIUM Press and Editors of the journal harmless against all copyright claims.

Transfer of copyright: The Author(s) hereby agree to transfer the copyright of the article to IIUM Press, which shall have the exclusive and unlimited right to publish the article in any form, including in electronic media. However, the Author(s) will reserve the right to reproduce the article for educational and scientific purposes provided that the written consent of the Publisher is obtained. For the article with more than one author, the corresponding author confirms that he/she is authorized by his/her co-author(s) to grant this transfer of copyright.