PUBLIC VENTURE IN PRIVATE COMPANIES THROUGH CROWDFUNDING METHOD OF PEER-TO-PEER LENDING IN MALAYSIA

DOI:

https://doi.org/10.31436/iiumlj.v30iS1.700Keywords:

crowdfunding, P2P lending, public, private company, Malaysia, Pendanaan ramai, pembiayaan P2P, awam, syarikat persendirianAbstract

Digital funding platforms have been contemporaneously developed and utilised as a medium to enable businesses and companies to seek funds and to raise capital for any kind of commercial purposes, at any time or place. Such technology allows the service providers to invite the public to participate in generating funds for the businesses and companies in need. Through this mechanism, it is factual that funds are contributed by the public, while the law clearly provides the restriction of the public to invest or deposit or hold equity in private companies. Allowing the public to directly invest in private companies would be considered as illegal considering the legal restriction imposed on the private companies under the statute. Therefore, this article aims to study the legality of venturing this public money into the business investment of private companies. The focus of this study is the governing law in Malaysia in respect of the legality of funding private companies through online social lending namely peer-to-peer lending (P2P lending). This study is conducted by way of contents analysis of various provisions of relevant legislations. The outcomes of this study show that digital social lending such as P2P lending, has grown and been accepted by various natures of enterprises and private companies in order to start-up their business operation in Malaysia, as it compliments the limitation for private companies to invite the public to venture into their business.

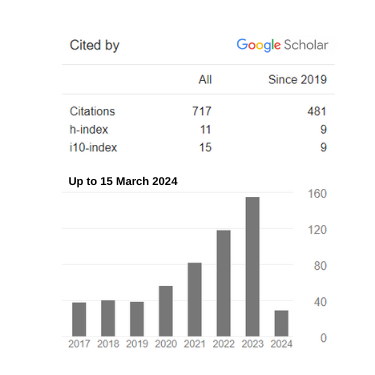

Metrics

Downloads

Published

How to Cite

Issue

Section

License

- Consent to publish: The Author(s) undertakes that the article named above is original and consents that the IIUM Press publishes it.

- Previous publication: The Author(s) guarantees that the article named above has not been published before in any form, that it is not concurrently submitted to another publication, and that it does not infringe anyone’s copyright. The Author(s) holds the IIUM Press and Editors of IIUM Law Journal harmless against all copyright claims.

- Transfer of copyright: The Author(s) hereby transfers the copyright of the article to the IIUM Press, which shall have the exclusive and unlimited right to publish the article in any form, including on electronic media. The Journal in turn grants the Author(s) the right to reproduce the article for educational and scientific purposes, provided the written consent of the Publisher is obtained.